Business Insurance in and around Auburn

One of the top small business insurance companies in Auburn, and beyond.

Insure your business, intentionally

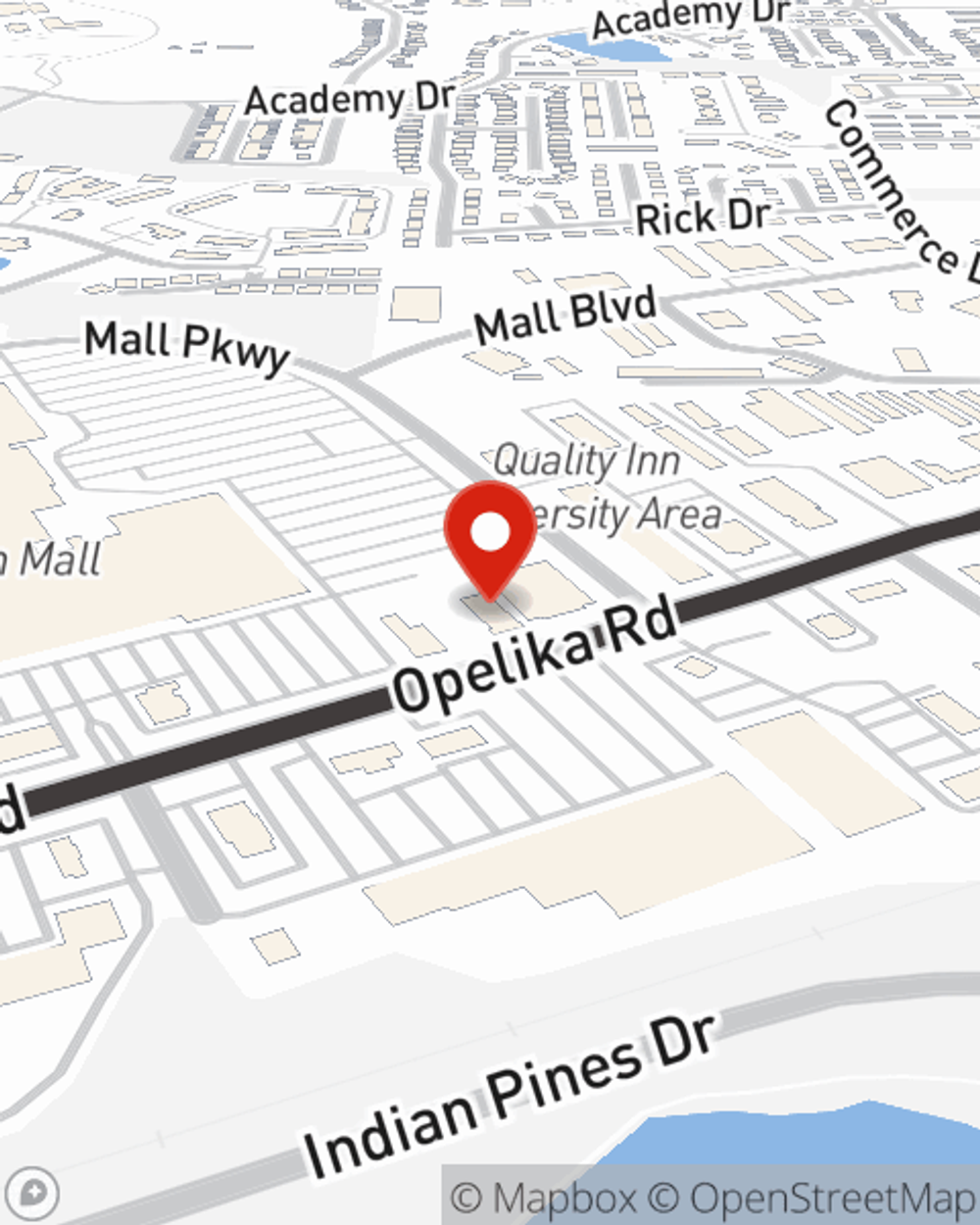

- Auburn, AL

- Opelika, AL

- Lee County, Alabama

- Alabama

- Georgia

- Auburn University

- Smiths Station

- Lee County

- Dadeville

- Waverly

- Alex City

- Auburn

- Opelika

Insure The Business You've Built.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, specialized professions and more!

One of the top small business insurance companies in Auburn, and beyond.

Insure your business, intentionally

Customizable Coverage For Your Business

Your business thrives off your passion commitment, and having reliable coverage with State Farm. While you support your customers and lead your employees, let State Farm do their part in supporting you with commercial auto policies, worker’s compensation and artisan and service contractors policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Kathy Powell is here to help you identify your options. Reach out today!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Kathy Powell

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.